What about 1099-MISC?

Home > Processing Payroll > What about 1099-MISC

What about 1099-MISC?

The 1099-MISC is still a valid form for other types of income including Royalties, Rents, etc. The form is still accessible when printing and when selected you can manually enter amounts in appropriate fields and print the form.

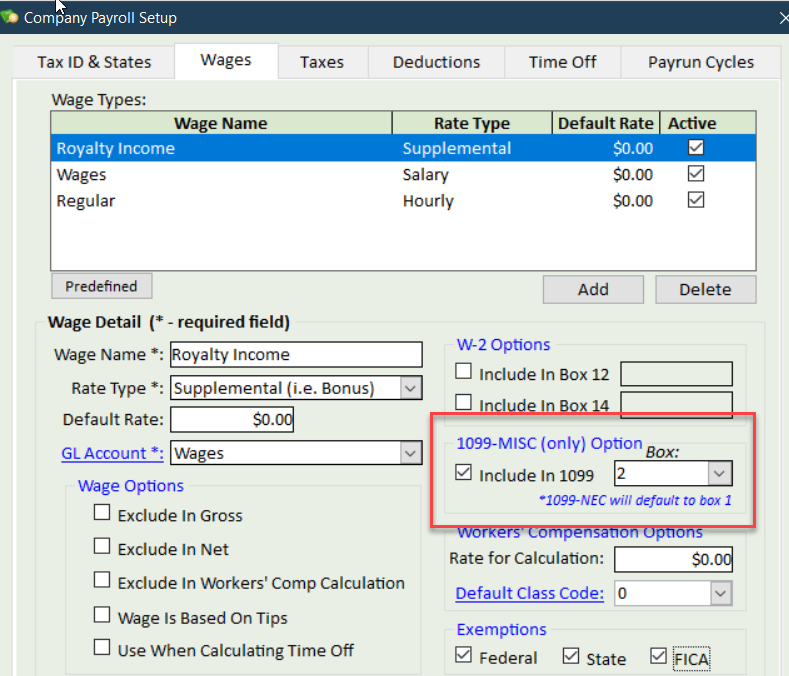

When creating wage types, you are able to specify a wage type to be reported on a specific box on the 1099-MISC form.

In these cases, when a payroll run is done where a contractor or employee uses a wage type that has a 1099-MISC form set, then the amounts in the payroll runs will be accumulated and reported on the 1099-MISC.

Note that if you have compensation that involve both the 1099-NEC and 1099-MISC forms that two copies of the 1096 will be needed.